Implementing ongoing Account Credit and Payment history recording

Available from finPOWER Connect version 2.03.02.

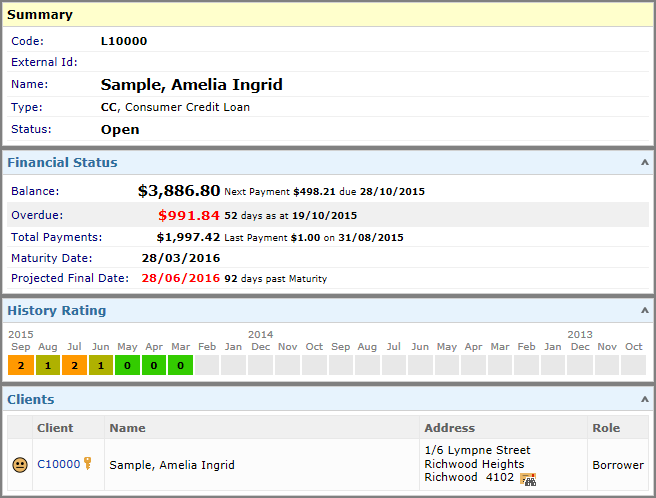

finPOWER Connect can be configured to show a graphical representation of a Loan Account's ongoing Credit and Repayment history. It reflects where the Loan is being paid "as agreed", and highlights where the Loan has fallen overdue.

The idea is that at the end of each month a "Rating" for the Account is calculated, e.g. a "0" means not overdue, "1" means less than 30 days overdue, "2" means less than 60 days overdue etc. This way a diagram can be displayed showing the Rating History for an Account over time.

This provides a quick and easy way to visualise how the Loan has progressed through its life - it is very easy to see bad Loans.

To use the standard History Rating functionality follow this procedure:

- Add the Script to process History Rating updates.

- Under the "Admin" menu, open "Scripts".

- Click on the "Import" action.

- Select "Script_AccountProcesses_AccountHistoryRatingUpdate.xml" from the "Templates\Sample Scripts" folder.

- This should import the "AP.HISTRAT" script.

- Save the new script.

- Link the script to run from Account Processes

- Open "Global Settings" from the Tools menu.

- Expand the "Accounts" group and select the "Scripts" page.

- Find the "AccountProcessesPre" script under "Events", and enter the new "AP.HISTRAT" script.

- Configure Account Types to show the History Rating diagram.

- Under the "Admin" menu, open "Account Types".

- For each Account Type you wish to utilise Account History for:

- Go the "Other" page and, under the Summary Page Options section, check "Show Account History Rating information?".

The History Rating diagram will then display in the Account Key Details and Status Summary Pages - but can be added elsewhere. It is only shown for "Open" Accounts, where the Account has a History Rating and the Account Type is set to use.

The "AP.HISTRAT" script has two parameters, "Calendar" and "DaysDelay". These control how quickly an Account is updated after the end of a Month. The default is 3 days, and allows the month to be finalised, payments and unpaid items to be processed etc, before the History is updated.

The full list of statuses are as follows:

- "0" = Prepaid or not overdue

- "1" = Less than 30 days overdue

- "2" = Less than 60 days overdue

- "3" = Less than 90 days overdue

- "4" = Less than 120 days overdue

- "5" = Less than 150 days overdue

- "6" = Less than 180 days overdue

- "X" = 180 days or more overdue

In addition the script will handle backdated transactions, if the Account Type is configured to backdate Transactions.

For help customising finPOWER Connect please contact your Intersoft Dealer.