Centrix Bureau Score

Available from finPOWER Connect version 2.03.03.

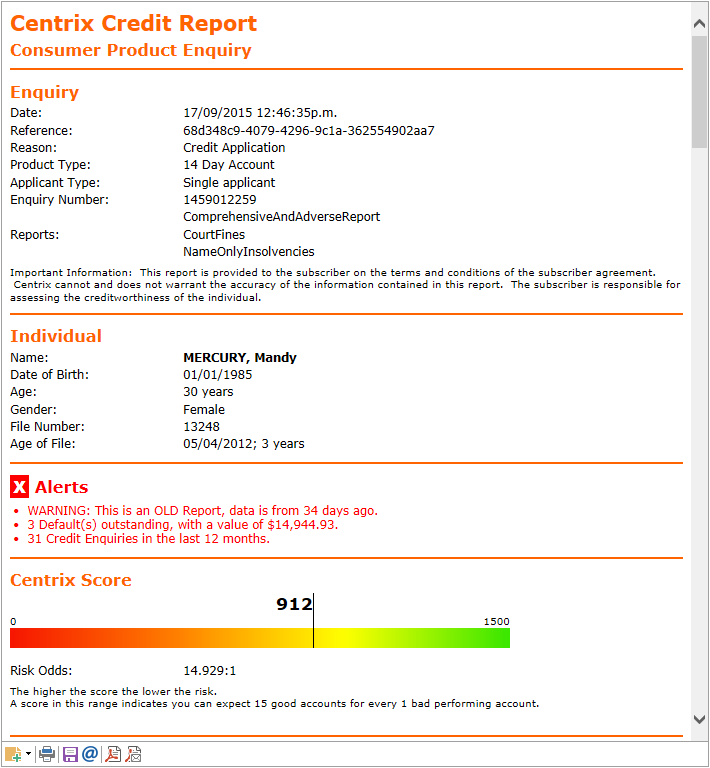

finPOWER Connect now incorporates the new Centrix Bureau Score in Consumer Product Enquiry reports using the Centrix New Zealand service.

The Centrix Bureau Score has been developed by Experian, a leading global information services company, and it predicts the odds of an Account going into a "bad state" in the next 12 months due to:

- 90 days+ in arrears

- Default

- Judgment

- Insolvency

The Score can be used to assist in credit decision processes and it can result in faster, more accurate, and more consistent credit decisions.

The Score is displayed in a graphical format, within a range of 0 - 1500 where the higher the Score the lower the risk. Included with the Score are the Risk Odds which indicate how many good performing accounts can be expected per bad performing accounts over the next 12 months for a score in this range.

In the example below, the individual has a Score of 912, and Risk Odds of 15 good accounts for every 1 bad performing account.

The Centrix Bureau Score will be included with any new Credit Report enquiry.

To use the Score follow this procedure:

- Run a Consumer Product Enquiry using the Centrix New Zealand service.

- From the "Client" menu, click "Credit Enquiry".

- Select the "CentrixNZ" service.

- Select the "Consumer Product Enquiry" product.

- Click "Next".

- On the Options page.

- Under Credit Enquiry options, check "Include Credit Report".

- Enter any other options.

- Click "Next".

- On the Individual page.

- Enter the details of the Individual on whom you are performing the credit enquiry.

- Click "Next".

The Score and Risk Odds will be displayed in the Summary Page in section named Centrix Score.

The Score may be used in Workflows, Decision Cards, Account Applications and Scripting to assist in your Credit Decision processes.

More information is available at https://www.centrix.co.nz/centrix/Business/score, or contact Centrix or your Intersoft Dealer.