New finPOWER Loan Application Processing Suite Released

We are pleased to announce the release of our new suite of Add-Ons for finPOWER - the Loan Application Processing Suite.

This major step forward in the development of finPOWER takes finPOWER from being just a Loan Management system to now being a full end–to-end suite that can cater for all your Loan origination, loan management and financial management needs. It takes finPOWER to a new level of proactive loan origination and incorporates a whole host of new features including Scoring, Task lists, Decisioning and Web Front End capabilities.

There are currently a number of clients using the Loan Application Processing Suite in a number of different situations, including one that has used it to integrate their call centre operations as well as their loan approval processes. They are enjoying the significant benefits it has bought them.

There are 6 Add-Ons in the Loan Application Suite:

- The Loan Application Add-On

- The Application Processing Add-On

- The Application Scoring Add-On

- The Web Front End Add-On

- The Agents Add-On

- The Credit Enquiry Add-On

The Loan Application Add-On

This Add-On gives you the ability to record and analyse details of Client income and assets.

A client’s Income and Expenses are recorded and a Net Income position is established. An Available Income value can then calculated and checked against new loans for the client. If the Available Income is insufficient to meet the payments the new loan should be declined.

Similarly, a client’s Net Asset position is established from recorded Assets and Liabilities and a Debt Ratio is calculated. This ratio can then be used to determine whether the client meets company lending criteria.

Using this Add-On can significantly improve the efficiency and methodology and assessing new loan applications.

Client's Assets, Liabilities, Income and Expense Details are recorded on the Client File.

When a Client applies for a new Loan, their ability to repay the loan and their resultant debt position is assessed according to the statistics recorded on their file.

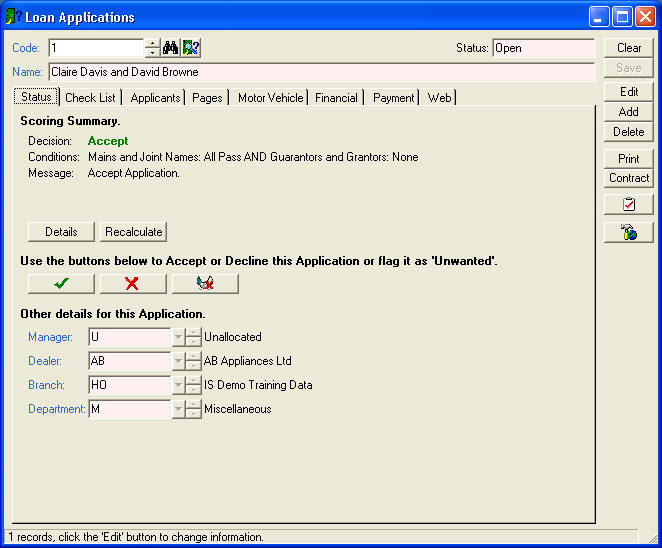

The Application Processing Add-On

The Application Processing Add-On is the heart of the new suite and provides the key functionality to facilitate the processing of a loan. It comes with the work flow for a standard Loan Application and also has a number of additional features such as:

- The Check List

- Status Summary page

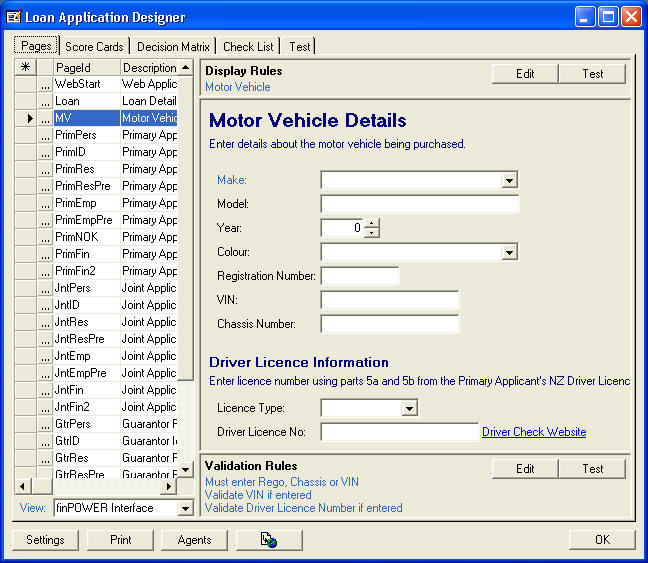

A key function of the Loan Application Processing Add-On is the Loan Application Designer that gives you the ability to modify any of the pages or rules contained in the standard Loan Application provided with the system. This allows complete freedom to add, modify and delete pages.

The Application Scoring Add-On

The Application Scoring Add-On allows you to create, modify and enhance your own set of Score Cards. Each scoring criteria has its own set of scores for a range of outcomes that generate a "Credit Score" for the application. This Credit Score is then used in the Scoring Matrix to assess the application and either Accept, Refer to Fail the application.

The Web Front End Add-On

This interface allows an HTML version of the Loan Application to be published to a Finance Company's website. This is suitable to capture Loan Application requests from potential borrowers finding a Finance Company via the Internet. Because it uses the same page layout, scoring and rules engine built into finPOWER (albeit modified for the Internet) it is a powerful loan application capture program, not just a simple submit form facility.

Once a Loan Application has been submitted by the borrower it is then pulled down to finPOWER to be processed, making this process much more productive.

The Agents Add-On

The Agents Add-On is a powerful tool used to set up access control to the finPOWER system by associated third parties. Each "Agent" (think Dealers, Group of Dealers, Brokers etc) can be established with their own Users (employees) list. Filters can then be applied that limit the Agent to specific types of Loans, the ability to modify fields within those loans and even specific areas of Loan Applications.

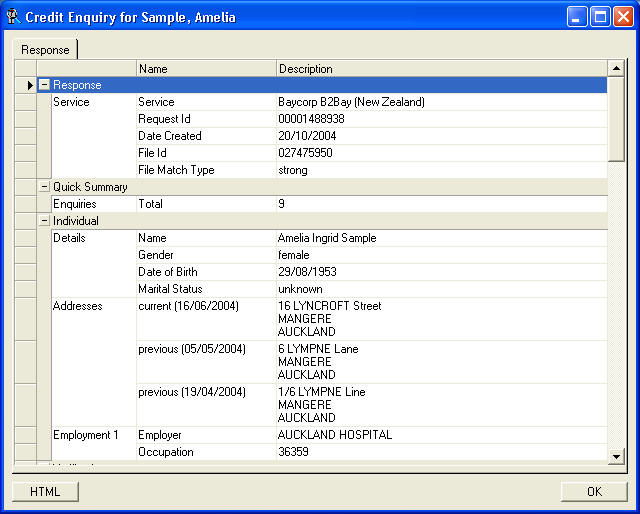

The Credit Enquiry Add-On

This Add-On allows a client to undertake a Baycorp Credit Check using the B2Bay interface. The functionality of this Add-on replicates what many clients already do manually, but allows you to do it from within finPOWER and using existing records. The resulting Credit Report is then stored within finPOWER.

We have developed some examples of what you can achieve with the new Loan Application processing suite that you can view on our Website. The following link demonstrates a standard ad-hoc loan Application that could appear on your website.

www.intersoft.co.nz/lap/application.asp or

www.intersoft.co.nz/laptesting/

The link below takes you into a Dealer / Agent administration area. This is a situation where you have say, Car Dealers, generating new loans for you. They can come to a website like this and enter new applications, enquire on the status of existing applications and review old applications.

www.intersoft.co.nz/lap/agents

Log in with the following:

User Name: Guest

Password: guest

As you can see this is a major step forward for finPOWER. It elevates finPOWER to a whole new level yet maintains it accessibility to the entire market. If you can see that this new suite will add to your business please contact your Dealer to discuss.